9 July 2020

The curious case of Wigan Athletic FC

Wigan Athletic is the first English club to go into administration post the COVID-19 induced lockdown and related suspension of football in England. How far can this situation be related to the lockdown, or is this reaction associated with ownership changes – which would be more symptomatic of the earlier crisis at Bury FC? The big question for English football going forward is how many of these financial struggles are attributable to the unforeseen pandemic, and how many are due to endemic problems of irresponsible owners, reinforced by a less than satisfactory test of suitability?

The background

Rising from the fourth division of English football, Wigan, under the leadership of David Whelan, maintained English Premier League (EPL) status for an impressive eight years and won the FA Cup in 2013. A few days after, Wigan got relegated to the Championship and this signalled the beginning of the club’s woes. A combination of managerial and boardroom changes saw Wigan relegated to League One before eventually regaining Championship status in 2018.

In 2018, the Whelan family – David Whelan had stepped down as board Chairman in 2015, replaced by his grandson David Sharpe – sold Wigan to International Entertainment Corporation (IEC), a Hong Kong-based company, for £22m. The new owners promised to follow the Whelan family’s long-term focus, traditions and values and restore on-field success. Therefore the news of IEC’s sale of Wigan in May 2020 to the Next Leader Fund (NLF) due to “unsatisfactory financial performance and uncertain prospect of the club” was at best confusing for their fans. With almost all the clubs in the Championship consistently reporting significant financial losses, either IEC’s due diligence wasn’t thorough, or they had over-estimated their ability to run a championship football club.

Curiously, NLF, who bought Wigan on 4 June 2020, had Dr Choi Stanley, (the majority shareholder of IEC), as its majority shareholder. On 24 June Mr Au Yeung, a minority shareholder of NLF, became the majority shareholder of NLF with 75% ownership. Both the sale of Wigan from IEC to NLF and emergence of Mr Yeung as Wigan’s owner passed the English Football League’s Owners and Directors Test. Days after NLF’s takeover, Wigan under the leadership of Mr Yeung paid back an existing £24m loan to IEC and put the club into administration; automatically attracting a 12 points deduction. With Wigan currently clear of relegation by only six points with five games to go, the points deduction might send them into League One.

The finances

English football is inundated with the delicate act of balancing revenue and expenses while remaining competitive. Wigan’s break-even-result (BER) – a measure that shows the operating profit/loss of clubs – has consistently hovered around £0. This might sound marginal, but actually in context is not unusual or an immediate cause for concern.

Wigan’s debt and cash-flow from operations (CFFO) figures – the most critical measures in assessing solvency – are more concerning and worsened during IEC’s leadership.

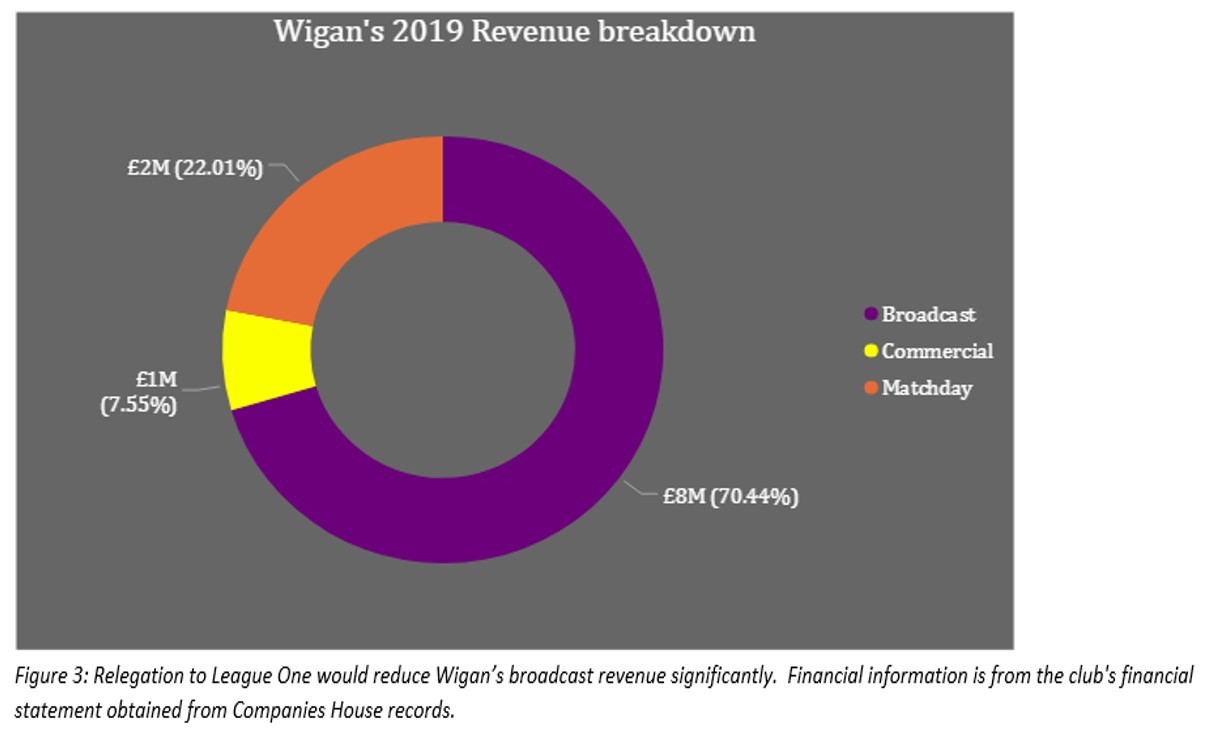

In terms of debt burden, Wigan has moved from on average 47%, to 100% short-term debt (debt due within one year); their CFFO has been consistently negative, and as of 2019, the club’s current assets were only able to settle 21% of its short-term debt. Further, as a result of COVID-19, the club would have to refund matchday revenue for the remaining 2019/2020 matches. With uncertainty about when fans will be allowed to return to stadiums, Wigan’s matchday revenue – which accounts for 22% of total revenue – cannot be counted on when 2020/2021 season starts.

The future

The decision to call in the administrators has been questioned by the media and fans alike, with many theories and conspiracy theories being discussed. These seem extremely speculative but reflect the unexpected and unexplainable nature of the recent activities around the change of ownership and the actions of the new owners.

As we discussed in an earlier article on Newcastle United, the Owners and Directors Tests used by the EPL and Football League need serious revision to reflect the current issues facing English football – some of which are a direct result of the pandemic, and others which have been made more pressing due to the resultant crisis in the game. So what can be done? We have some ideas as follows:

- Bring in ethical criteria: where potential owners’ other business dealings should reflect the values of the EFL, EPL, and the UK.

- Think about business continuity criteria: for instance, owners could provide a five-year business model detailing financial and footballing plans. Currently, new owners are only required to show proof of funds needed to purchase the club.

- More drastically, invoke a minimum fund/capital requirement: this would be similar to the Capital Adequacy Ratio requirement for banks (under Basel III). For instance, this could look at a 25% cash-flow from operations to revenue ratio for all clubs. Currently, the ratio is between 23% and -6% for the top and bottom six clubs in the EPL respectively.

The weeks and months ahead will be crucial for the survival of football and in particular for the game in England. Whilst many of the issues to be faced will be guided by Government policy, the leagues, the safety of the teams and fans, and society at large – it is becoming clear that appropriately regulating club ownership is an immediate and pressing problem that cannot be put off any longer.

Mobolaji Alabi and Professor Adrian Bell

Source: Henley Business School News