Critical-Chains Stakeholders and Roles

Critical-Chains primary stakeholders are as follows:

- Citizens and Companies as Bank Account Holders

- Citizens and Companies as Insurance Policy Holders

- Companies as a Contractee in any Financial Transaction

- Banks as Financial Authorities, Financial Services Providers and Contractor

- Central Counter-Party organisations (CCPs) as Clearing and Settlement Services Providers

- Trading venues and Multilateral Trading Facilities (MTF) as alternatives to the traditional stock exchanges where a market is made in securities, typically using electronic systems (especially cryptocurrency stock markets)

- Public Sector, Including Financial Services Security Monitoring & Regulatory Agencies

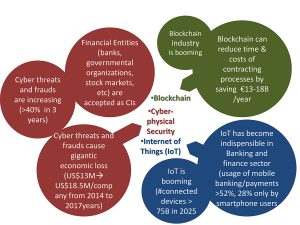

The Socio-Economical-Technical Needs Context

Irregular and unaccountable transactions, cyber threats, non-user-friendly inefficient or impractical banking processes, complex contracting procedures and cumbersome financial market and insurance infrastructures constitute obstacles to European open market development.

Critical-Chains Responsible and Responsive Innovation

| Enabling Technologies Responsive to the Socio-Econo-Technical Requirements |

|

| The underpinning concept of the project is the holistic protection and augmentation of the value of the chain through accountable, blockchain-enabled, practical, secure, privacy preserving, scalable and effective “Secure & Smart Contracts” and “Secure Transactions” in banking, CCP and insurance sectors. |